Why is Pain Research and Development So Expensive?

In this article, we will explore why pain research is so expensive, and how our B2B platform, Pain Cloud®, can help to reduce these costs, paving the way for a brighter future for pain patients and the market as a whole.

It is evident that the economic cost of pain is incredibly high – and there are few signs that these will reduce any time soon.

As of 2022, the cost of pain treatment in the US was estimated to be between $261 billion and $300 billion alone and, with the addition of lost work days and other factors, it exceeds the cost of managing cancer and heart disease combined.

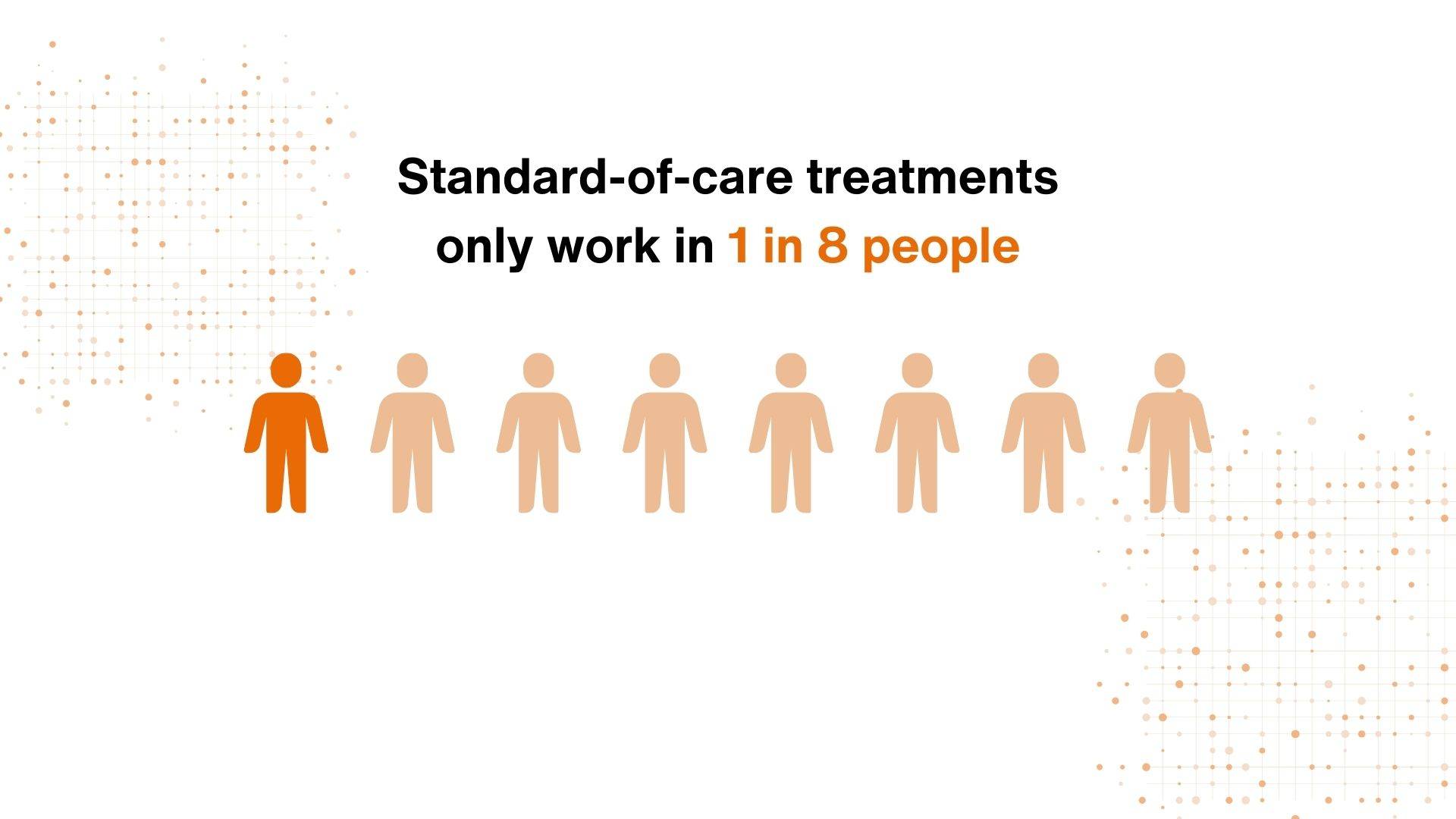

To add to this the standard-of-care treatments only work in 1 in 8 people, meaning that we need research to develop new more effective medicines.

As well as direct healthcare costs, productivity loss and lost work hours, it is the pain R&D efforts to develop new analgesics that make up the significant part of these expenses – yet action isn’t being taken to make the process more streamlined and efficient.

The cost of producing new analgesics

When it comes to pinpointing the economic costs of pain, analgesic research and development plays a significant part.

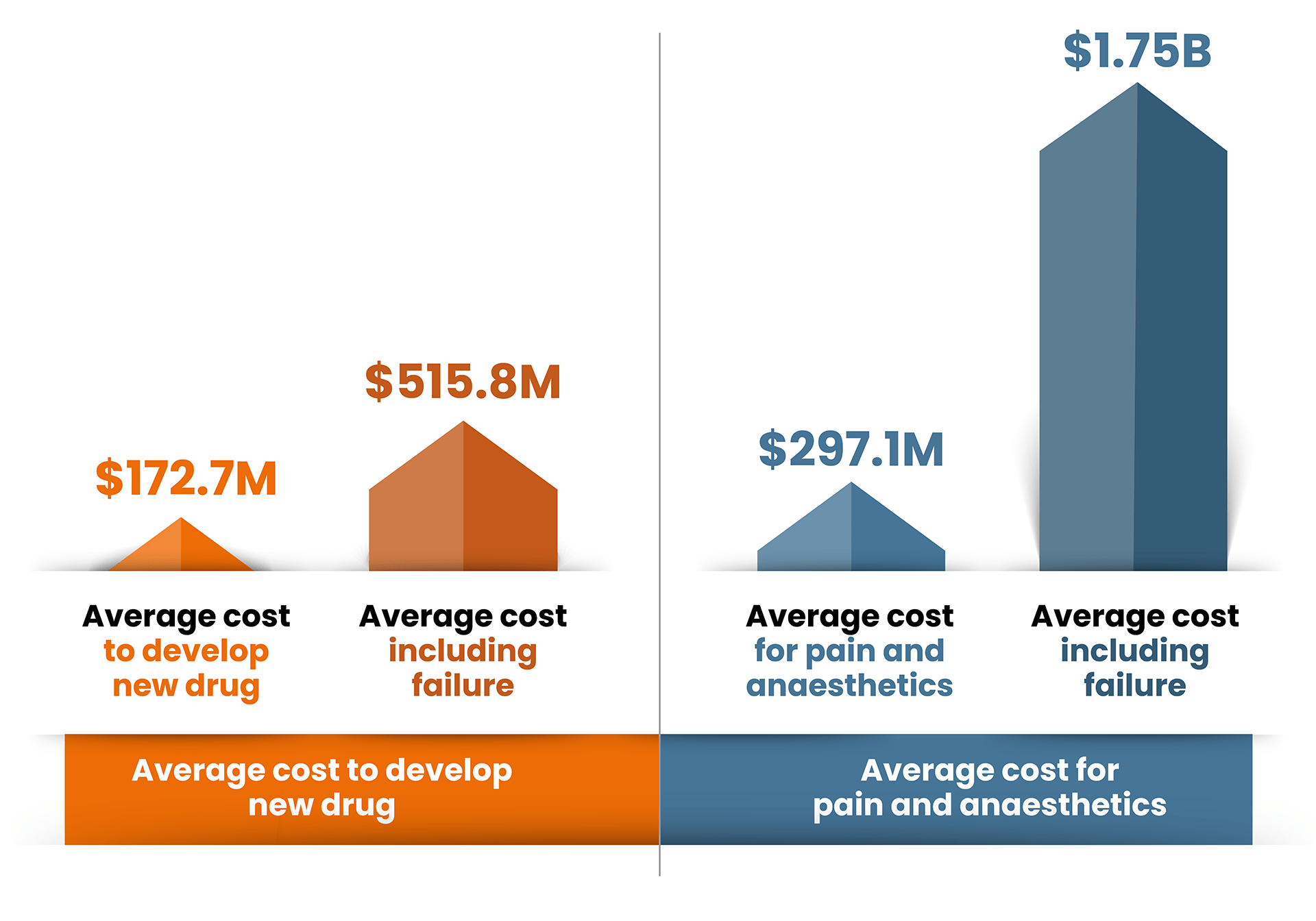

Research published by JAMA Network1 in June 2024 found that the estimated mean cost of developing a new drug was around $172.7 million. They looked across different therapeutic areas and found there was a significant difference between them with the lowest being $72.5 million for genitourinary to the most expensive $297.1 million for pain and anaesthetics.

These figures include post-marketing studies – but they don’t include the cost of failure.

When you add the cost of drugs failing in development, the average figure becomes $515.8 million and once again pain and anaesthetics is the most expensive therapeutic area with costs of a staggering $1756.2 million.

Earlier research had suggested the average cost of developing a drug was even more expensive e.g. Frontiers analysed four studies2, 3, 4, 5 which found that the estimated cost of R&D per new medicine varies between $944 million and $2,826 million, and that these costs will increase over time.

The cost of clinical development

The clinical stage of research makes up the majority of pain R&D costs and, for the pain area, this makes up a considerable 85.8% share1.

The costs to develop a new pain drug themselves are shocking, but the need for change becomes even more apparent when you realize the clinical success rate of new analgesics sits at just 1%6. Hundreds of millions are being spent on clinical development with little chance of success.

What is the solution?

It is evident that change is needed to prevent the excessive costs caused by traditional pain R&D methods.

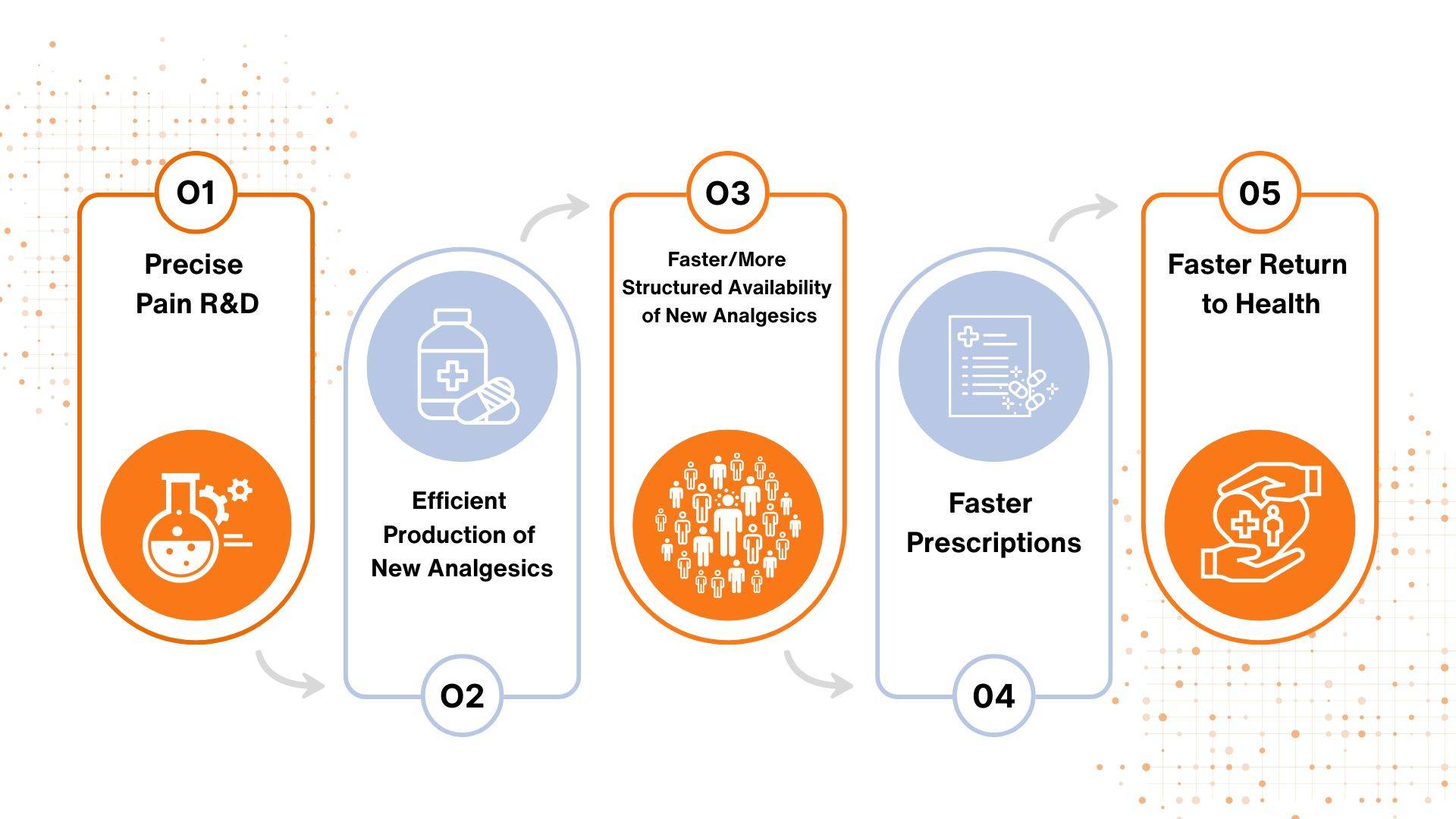

Finding a solution that reduces cost and time spent and efficiently links target to disease starts with identifying the optimal pain group for each new drug.

To date, industry has not taken the time to understand the complexity of diseases and conditions associated with pain and focused development in just a limited number of around 10 clinical conditions.

Pain does not discriminate, so focusing only on a limited number of diseases with regulatory pathway effectively excludes millions of pain patients, exhibiting different experiences and symptoms, from the research process.

Even the limited number of patient groups used in industry need new treatments as current medicines only work for 1 in 8 of these patients. The diseases are complex and heterogeneous, so patient stratification is required to make target validation more accurate.

Identifying the optimal pain group is crucial in aiming for the highest probability of success. But, in the pain area, this has proven exceptionally difficult due to limited target validation technologies.

The fact is, the R&D process has not changed in over 20 years, relying on non-translatable preclinical models with no ‘target-to-disease’ links established. This results in a subpar, inaccurate target validation process that fails to serve pain patients and leads to the 1% clinical success rate.

Pain Cloud® uses Personalized Analgesics® research to drive a patient-centered approach to creating new pain treatments with precision efficacy

How can Pain Cloud® help?

The Pain Cloud B2B platform, created by eptivA Therapeutics and Infopoly Ltd., uses the first precision medicine approach to pain, creating:

-

-

- Network biology derived disease phenotype signatures

- Links to optimal pain disease from over 1000 conditions

- Increased clinical success

- Reductions in cost

-

The pain phase II industry focus consists of large yet homogenous patient groups of which standard-of-care treatments only work in small subpopulations and present severe side effects.

Our Personalized Analgesics bioinformatic approach creates thousands of nodes of data via novel human-focused network biology, all linked to our proprietary Pain Landscape® database of thousands of diseases7.

By using Pain Cloud’s technology, analgesic development will be quicker, less expensive, and more successful. It is hoped that safer, more efficacious, and more targeted pain medications, utilizing insights from Pain Cloud, will become available to those who need it most in the next few years.

This approach, which prioritizes speed, efficiency and accuracy, will start a positive chain reaction, resulting in further efficiency across every stage of analgesic development.

Find out more about how Pain Cloud improves target validation in this article and get in touch if you have any questions.

- Sertkaya A PhD, Beleche T PhD, Jessup A PhD, et al. (2024). Costs of Drug Development and Research and Development Intensity in the US, 2000-2018. [Online]. JAMA Network Open. Last Updated: 28 June 2024. Available at: https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2820562 [Accessed 2 August 2024].

- DiMasi JA, Hansen RW, Grabowski HG. The price of innovation: new estimates of drug development costs. J Health Econ. 2003 Mar;22(2):151-85. doi: 10.1016/S0167-6296(02)00126-1. PMID: 12606142. Available at: https://pubmed.ncbi.nlm.nih.gov/12606142/ [Accessed 2 August 2024]

- Mestre-Ferrandiz, J., Sussex, J. and Towse, A. (2012) The R&D Cost of a New Medicine. OHE Monograph. Available at: https://www.ohe.org/publications/rd-cost-new-medicine/ [Accessed 2 August 2024]

- Paul SM, Mytelka DS, Dunwiddie CT, Persinger CC, Munos BH, Lindborg SR, Schacht AL. How to improve R&D productivity: the pharmaceutical industry’s grand challenge. Nat Rev Drug Discov. 2010 Mar;9(3):203-14. doi: 10.1038/nrd3078. Epub 2010 Feb 19. PMID: 20168317. Available at: https://pubmed.ncbi.nlm.nih.gov/20168317/ [Accessed 2 August 2024]

- DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016 May;47:20-33. doi: 10.1016/j.jhealeco.2016.01.012. Epub 2016 Feb 12. PMID: 26928437. Available at: https://pubmed.ncbi.nlm.nih.gov/26928437/ [Accessed 2 August 2024]

- Thomas, D., Wessel, C. BIO Industry Analysis. The State of Innovation in Pain and Addiction Addiction Therapeutics, (2023)

- Field, MJ WO2023058000A1 – Platform for identifying novel analgesic therapies …” published patent (2023)